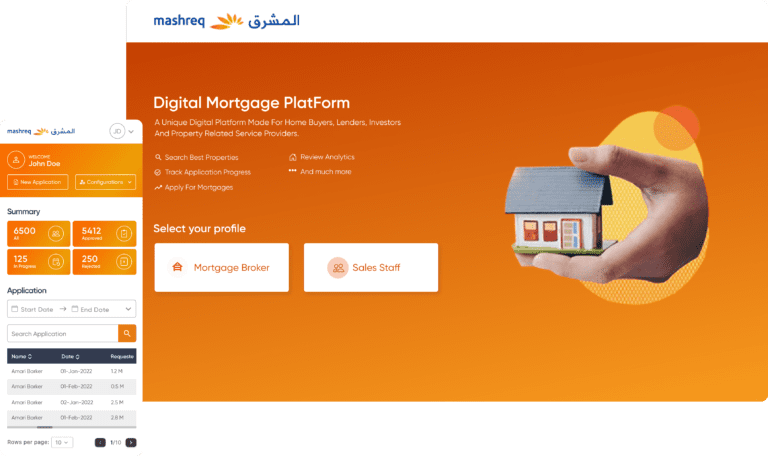

Overview

Mortgage platforms provide digital solutions designed to assist home buyers, lenders, investors and service providers of property-related products and services in all stages of purchasing homes or loans.

These platforms streamline mortgage application, approval and servicing processes - simplifying them for both borrowers and lenders - making life simpler for everyone involved in managing mortgage transactions

Technologies Used

- Front-End:React.JS

- API’s/Back-End:Node.JS

- Database:MongoDB

- Server:Locally Hosted

- Country:UAE

Requirements

Mashreq Bank, an innovative financial institution with offices throughout the Middle East and North Africa and globally, is well known for its pioneering spirit and innovative thinking.

Our Digital Mortgage Platform was devised as a solution for an outdated mortgage process characterized by extensive paperwork and long approval times; part of their mobile banking suite offering innovative banking features on smartphones that makes mortgage financing accessible through apps like Mashreq.

This platform promises to transform how individuals secure home financing using apps from Mashreq like this one!

Key benefits such as quicker approval times, lower costs and enhanced customer satisfaction speak to its success.

Furthermore, as this platform evolves it continues to make homeownership more accessible and affordable while drastically altering the mortgage landscape.

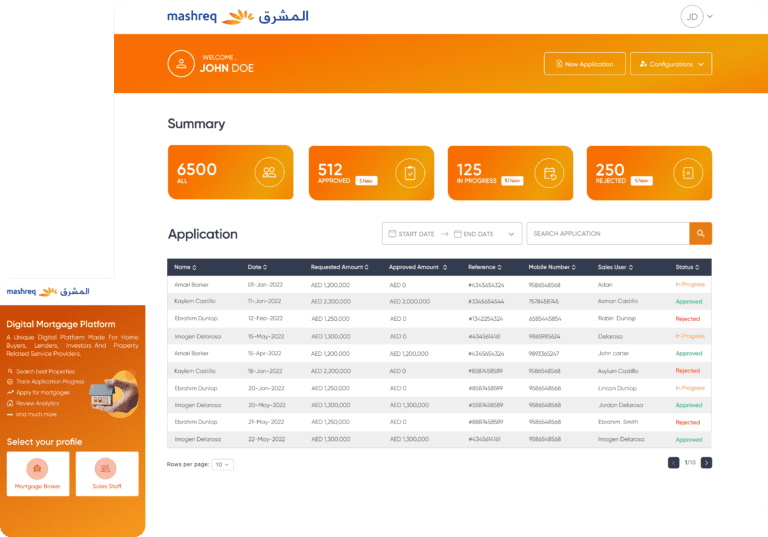

Key Features

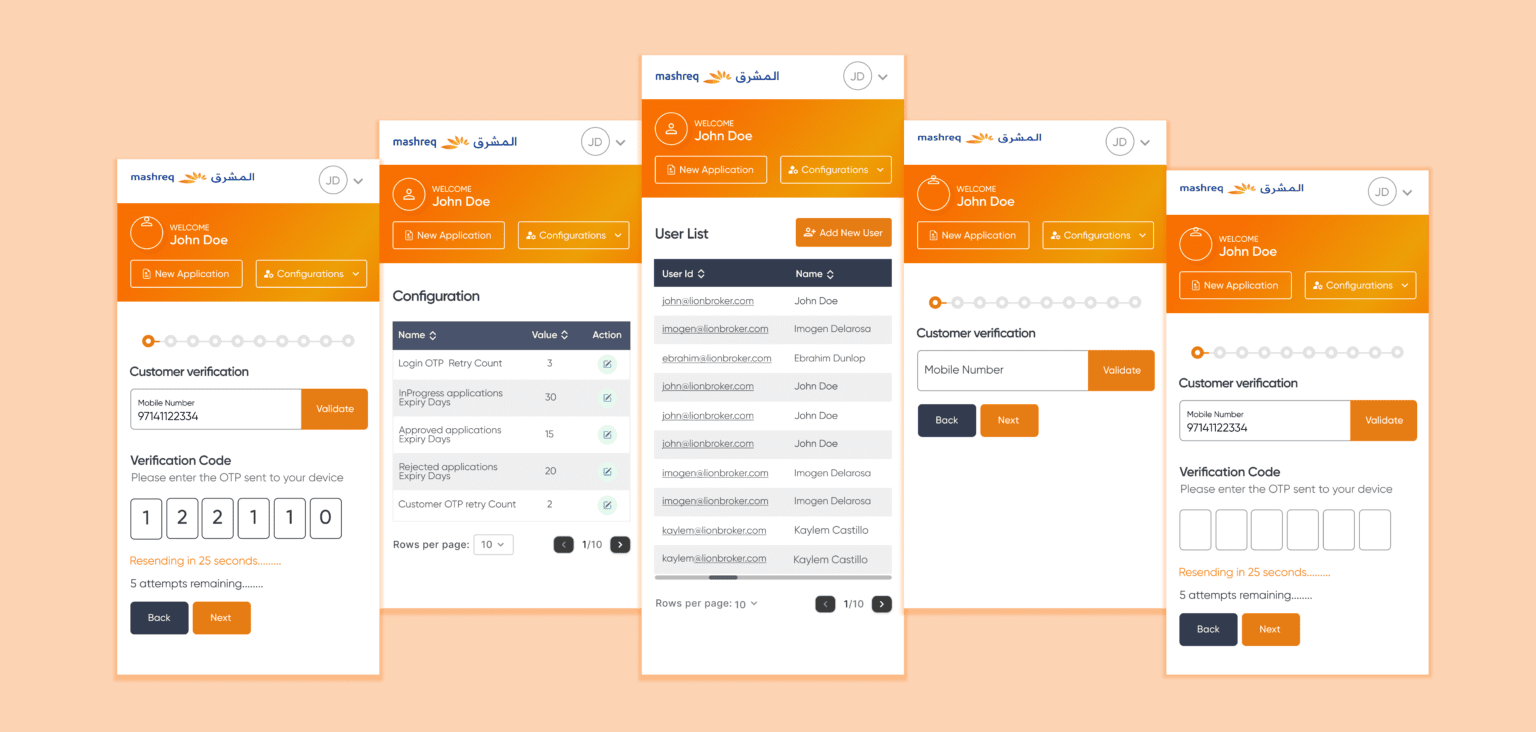

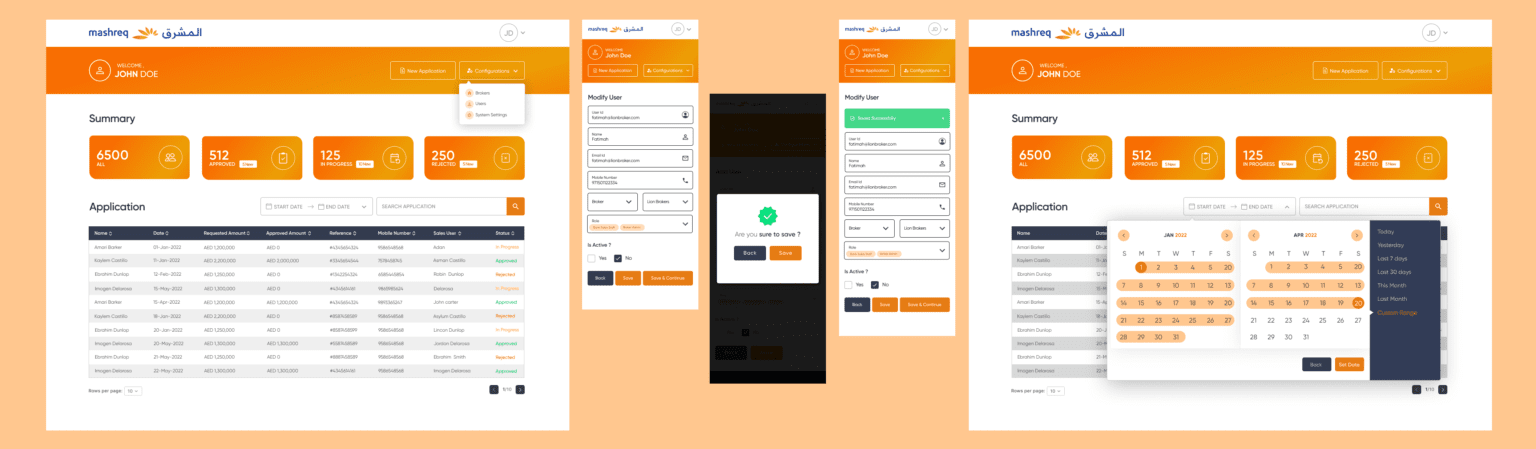

- (Log In/Log Out)For Mortgage Brokers and Sales Staff alike, accessing their accounts securely using Mashreq Bank mobile apps is now easier than ever, offering easy login with credentials for access.

- Online Application and Prequalification:Borrowers using Mashreq Mobile Banking Platform complete applications and utilize prequalification tools to estimate loan eligibility.

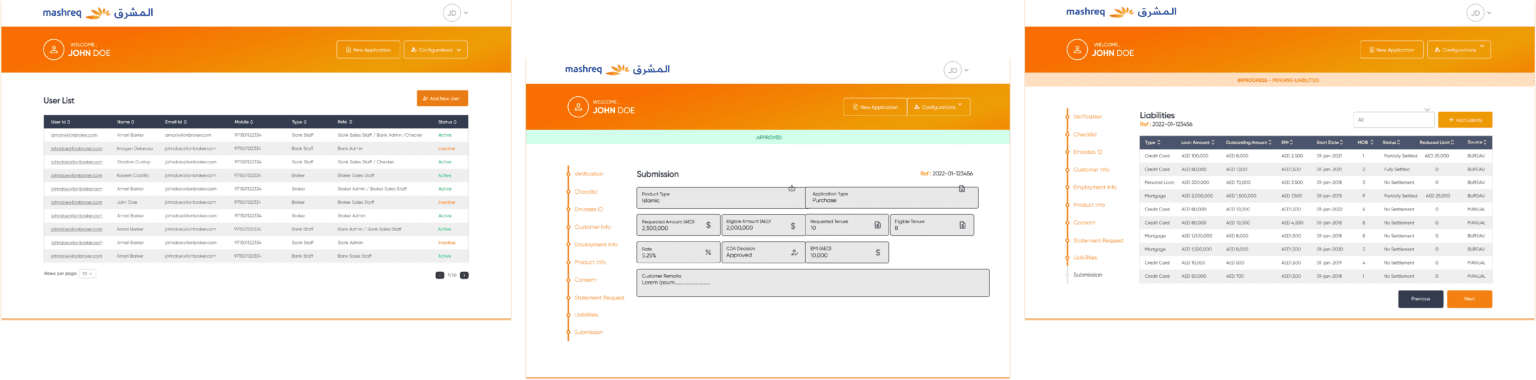

- Track Application Progress:With Mashreq Bank's mobile app, users are able to monitor loan applications from start to finish for maximum transparency and clarity.

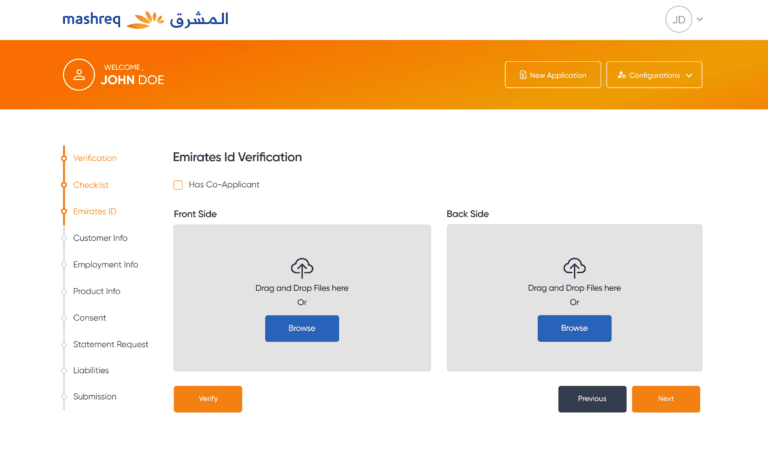

- Document Management and Upload:Our platform facilitates secure document uploads with automation for validation purposes, streamlining the process with automation for validation purposes.

- Document Management and Upload:Our platform facilitates secure document uploads with automation for validation purposes, streamlining the process with automation for validation purposes.

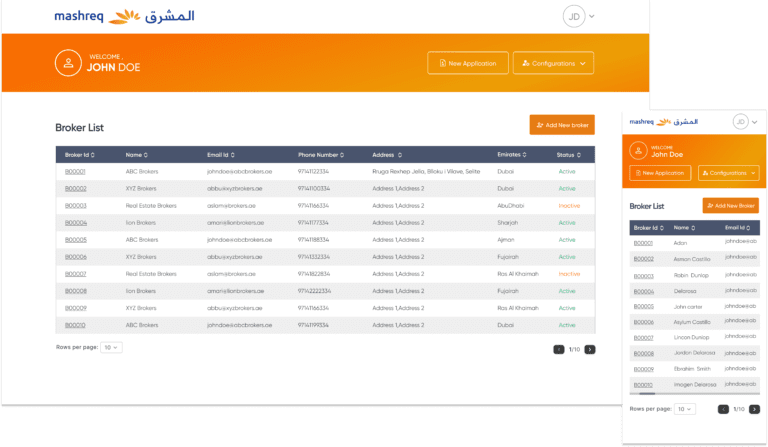

- Broker Listing:Mashreq's home loan process can be further improved through easy creation and management of broker accounts on this platform.

- Property Listings:Brokers use Mashreq Bank's app to list property with in-depth details and images that can be easily accessible to buyers and tenants alike.

- Reporting and Analytics:Exhaustive tools offer insight into mortgage performance for strategic decision-making purposes.

Benefits

- Time Efficiency:

The Mashreq Digital Mortgage Platform cuts down mortgage approval times, benefiting from the speed of theMashreq Bank mobile app. - Cost Savings:

Automation and reduced physical documentation lower operational costs, making the process more economical. - Enhanced Customer Experience:

The user-friendly interface of theMashreq mobile bankingapp and real-time updates increase customer satisfaction. - Risk Mitigation:

Advanced AI in credit scoring and risk assessment on the platform aids lenders in making informed decisions, reducing default risks.

Challenges

- Security Concerns:

The digital nature of the process necessitates ongoing investment in cybersecurity to protect sensitive information. - Adoption and Training:

Encouraging users to adapt to theMashreq mobile bankingapp and ensuring proficiency among all stakeholders remain challenges.

Conclusion

The Mashreq Digital Mortgage Platform, through its innovative use of technology in the financial sector, redefines efficiency, transparency, and customer satisfaction in home financing. Its continued success hinges on adapting to industry changes and upholding the highest security and reliability standards, making the Mashreq Bank app a key tool in modern mortgage processing.

Ready to create your own success story?

Contact Infin Mobile Solutions today to discuss how we can create a custom digital mortgage platform tailored to your needs.

Let's make homeownership more accessible and efficient. Reach now and take the first step towards digital transformation in mortgage processing.